Explain how the clearing corporation reduces the risk it faces in the futures market through the use of margin accounts and marking-to-market.

What will be an ideal response?

The clearing corporation requires each party to a futures contract to place a deposit with the corporation. This practice is called posting margin in a margin account. The margin account serves as a guarantee that when the contract comes due the parties can meet their obligations. Minimum deposits must be maintained in these accounts or the contracts are sold. The daily process of marking to market has the corporation posting gains and losses to each party's account. Again, this guarantees that obligations are met. If an individual's margin account falls below the minimum required the contract will be sold.

You might also like to view...

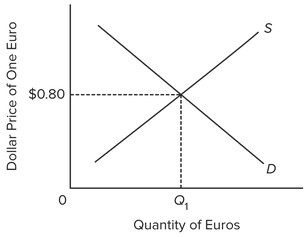

Use the following graph to answer the next question. All else held constant, a leftward shift of the demand curve would ________.

All else held constant, a leftward shift of the demand curve would ________.

A. cause a surplus of euros B. appreciate the euro C. depreciate the dollar D. reduce the equilibrium quantity of euros

When the income distribution is described by and labeled A, what is the value of the Gini coefficient?

a. 0

b. 45

c. 1

d. 2

When the short run aggregate supply curve shifts left, it ___ the short-run Phillips curve

a. Moves the economy up along b. Moves the economy down along c. Shifts right d. Shifts left

Discuss the fixed and variable costs of operating a farm. Which makes up a greater percentage of the total costs?

What will be an ideal response?