A deadweight loss results from the imposition of a tax on a good because the tax

a. induces the government to increase its expenditures.

b. reduces the quantity of exchanges between buyers and sellers.

c. causes a disequilibrium in the market.

d. imposes a loss on buyers that is greater than the loss to sellers.

B

You might also like to view...

To achieve long-run equilibrium in an economy with a recessionary gap, without the use of stabilization policy, the inflation rate must:

A. not change. B. increase. C. decrease. D. either increase or decrease depending on the relative shifts of AD and AS.

Since the 1960's, consumer spending in the U.S. has been approximately ________ percent of disposable income, whereas saving has been approximately ________ percent of disposable income

a. 30; 70 b. 50; 50 c. 65; 35 d. 90; 10

Economists who view the AS curve as vertical believe that government ________________ to raise Real GDP (in the short run) from the demand side of the economy. Economists who view the AS curve as upward-sloping believe that changes in Real GDP (in the short run) _________ result from changes on the demand side

A) can do many things; cannot B) cannot do anything; may C) can do many things; may D) cannot do anything; cannot

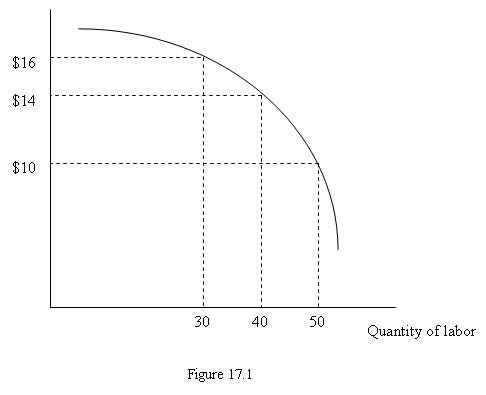

Figure 17.1 depicts a firm's marginal revenue product curve. If the product price decreases, the marginal revenue product curve:

Figure 17.1 depicts a firm's marginal revenue product curve. If the product price decreases, the marginal revenue product curve:

A. shifts downward. B. shifts upward. C. remains the same. D. None of these