They did not have any adjustments to income. What amount of Mr. & Mrs. Tsayongs Social Security benefits is taxable this year?

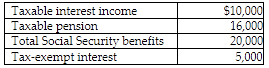

Mr. & Mrs. Tsayong are both over 66 years of age and are filing a joint return. Their income this year consisted of the following:

A) $0

B) $4,500

C) $10,000

D) $20,000

B) $4,500

Provisional income is $41,000 ($10,000 + $16,000 + $10,000 [one-half of Social Security payments] + $5,000 tax-exempt interest). $41,000 - $32,000 baseline amount = $9,000 × 0.50 = $4,500 taxable benefits (subject to the ceiling limit of one half of Social Security benefits, which is $10,000). Eighty-five percent of a portion of the Social Security benefits are subject to tax only if provisional income exceeds $44,000 on a joint return, or $34,000 for a single taxpayer.

You might also like to view...

Despite your best intentions, it's hard to bring the best evidence to bear on your decisions. Why?

A. It is too expensive; and it's not ethical and there's not enough good evidence. B. It will hurt diversity and synergy within your organization. C. There's no competition, or there's too much competition. D. There's too much evidence; and there's not enough good evidence and the side effects outweigh the cure. E. People are trying to mislead you; and the evidence will not allow MBO.

Sales of luxury goods such as perfumes, colognes, and aftershaves depend heavily upon their initial response by the consumer. A well-designed package can create convenience and promotional value. It has been called the "silent salesman

" Which of the three levels of packaging is this "silent salesman"? A) retailer B) consumer C) shipping D) secondary E) primary

Attributes of Auditors Discuss the three or more attributes that an auditors possess in order to maintain credibility. Explain the importance of these attributes to the audit

People in the same demographic group generally exhibit similar psychographic profiles

Indicate whether the statement is true or false