Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.John Rosar, framer, earned $34,503.87

A. $4,278.48, $1,000.61

B. $2,139.24, $1,000.61

C. $2,139.24, $500.31

D. $4,178.48, $900.61

Answer: A

Mathematics

You might also like to view...

Identify the digit with the given place value.366.215 thousandths

A. 0.005 B. 300 C. 6 D. 5

Mathematics

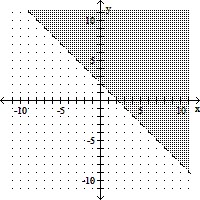

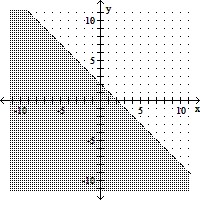

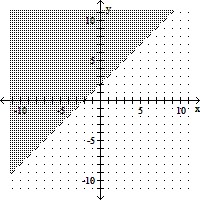

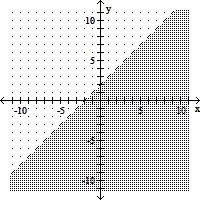

Graph the inequality.x - y < -2

A.

B.

C.

D.

Mathematics

Find the expected value of the probability density function to the nearest hundredth.f(x) = 3x-4; [1, ?)

A. 1.25 B. 1.50 C. 1.75 D. 1.00

Mathematics

By graphing the function, visually estimate its domain and range.f(x) =

A. Domain: (-?, -2] ? [2, ?); range: (-?, ?) B. Domain: (-?, ?); range: [0, ?) C. Domain: (-?, -2] ? [2, ?); range: [0, ?) D. Domain: [-2, 2]; range: [0, ?)

Mathematics