Suppose that net investment in 2016 was $20 billion and depreciation was $4 billion. Gross investment in 2016 was

A. $16 billion.

B. $20 billion.

C. $24 billion.

D. $28 billion.

Answer: C

You might also like to view...

Roughly what is the required reserve ratio within the U.S. banking system?

A) Less than 10 percent. B) 15% C) 25% D) 50% E) 90%

The change in total costs when output changes is called

A) average variable costs. B) marginal product. C) average total cost. D) marginal cost.

For any value of the required reserve ratio (RRR), the demand deposit multiplier is

a. 1/RRR b. 1 - (1/RRR) c. RRR multiplied by the change in reserves d. 1 - RRR e. (1/RRR) -1

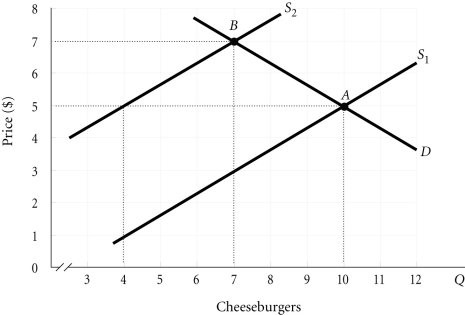

Refer to the information provided in Figure 3.19 below to answer the question(s) that follow. Figure 3.19Refer to Figure 3.19. The market is initially in equilibrium at Point A. If supply shifts from S1 to S2, the new equilibrium price will be ________ and the new equilibrium quantity will be ________.

Figure 3.19Refer to Figure 3.19. The market is initially in equilibrium at Point A. If supply shifts from S1 to S2, the new equilibrium price will be ________ and the new equilibrium quantity will be ________.

A. $7.00; 7 B. $7.00; 6 C. $5.00; 10 D. $5.00; 4