The U.S. tax system as a whole is basically

A. Proportional.

B. Progressive.

C. Regressive.

D. Variable in its impact because it changes from one year to the next.

Answer: A

You might also like to view...

From 2002 to 2011, the average unemployment rate in the United States

A) was higher than the average unemployment rates in most high-income European countries. B) and the average unemployment rates in other high-income countries varied significantly. C) was roughly the same as the average unemployment rates in other high-income countries. D) was the lowest of all high-income countries.

What is the Nash equilibrium of this one-shot game?

a. Firm A will charge a lower price and firm B will charge a lower price b. Firm A will charge a higher price and firm B will charge a lower price c. Firm A will charge a lower price and firm B will charge a higher price d. Firm A will charge a higher price and firm B will charge a higher price

If you are using a credit card prudently, you should

A) pay only the interest on any outstanding balance. B) make only the minimum payment each month. C) gradually expand the amount borrowed to the card's credit limit. D) pay the balance in full each month.

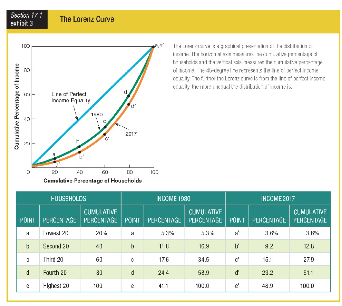

Based on the graphic showing the Lorenz Curve, if income distribution fell on the line of perfect income equality, what percentage of total income would the first 40 percent of households receive?

a. 3.8

b. 9.2

c. 13.0

d. 40.0