A firm that specializes in buying other firms' accounts receivable is called a(n)

A. factor.

B. broker.

C. credit officer.

D. agent.

E. trustee.

Answer: A

You might also like to view...

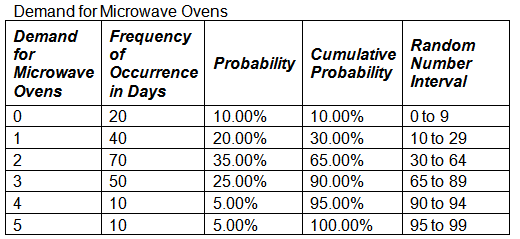

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 71, 63, 16, 9, 66, and 75?

a. 8

b. 9

c. 10

d. 12

Odiferous Waste Company is a subsidiary of Precarious Investments, Inc. Odiferous operates a hazardous waste disposal site. QuikChem Corporation is one of many parties who generate waste disposed of at the site. Odiferous borrows money from Regal Bank, which takes over the site when Odiferous goes bankrupt. The Environmental Protection Agency discovers a leak at the site. Can any of these private parties be forced to pay for the clean up? If so, who?

What will be an ideal response?

Riviera Township reported the following data for its governmental activities for the year ended June 30, 20X9: ItemAmountCash and cash equivalents$1,000,000 Receivables 300,000 Capital assets 8,500,000 Accumulated depreciation 1,200,000 Accounts payable 400,000 Long-term liabilities 4,000,000 Additional information available is as follows:All of the long-term debt was used to acquire capital assets. Cash of $475,000 is restricted for debt service.Based on the preceding information, on the statement of net assets prepared at June 30, 20X9, what amount should be reported for net assets, unrestricted?

A. $425,000 B. $825,000 C. $900,000 D. $525,000

Oberley Products, Inc., has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below: Capacity in units 47,000Selling price to outside customers$67Variable cost per unit$33Fixed cost per unit (based on capacity)$19?The Industrial Products Division is currently purchasing 5,000 of these receivers per year from an overseas supplier at a cost of $58 per receiver.?Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $6 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs.

What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division? A. $46 per unit B. $67 per unit C. $58 per unit D. $61 per unit