How do direct controls and specific taxes affect externalizes? Briefly explain in terms of supply and demand

Please provide the best answer for the statement.

Direct controls through laws or regulations that limit private activity are commonly used to curb private activity that is deemed to cause negative externalizes. In essence, direct controls either restrict production or raise the private costs of doing business and decrease the supply curve, thus raising product price and decreasing output. Similarly, the imposition of a tax on a polluting firm will raise the cost of doing business. This action will decrease supply, raising price and reducing output.

You might also like to view...

Land suitable for growing corn is usually suitable for growing soybeans. From the farmer's perspective, an increase in the price of corn will therefore tend to

A) decrease the demand for soybeans. B) increase the demand for soybeans. C) increase the supply (curve) of corn. D) raise the cost of growing soybeans. E) reduce the cost of growing soybeans.

Suppose the market equilibrium price of wheat is $5 per bushel, and the government sets a price floor of $7 per bushel to aid growers. What is the most likely result of this action?

a. There will be a shortage of wheat. b. There will be a surplus of wheat. c. There will be an increase in the quantity of wheat demanded as the result of the price floor. d. There will be a decrease in the quantity of wheat supplied as the result of the price floor.

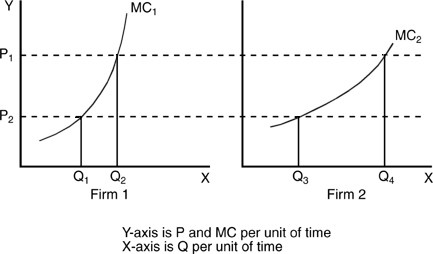

In the above figure, assuming Firm 1 and Firm 2 are the sole producers in the industry, the industry quantity supplied at price P2 is equal to

In the above figure, assuming Firm 1 and Firm 2 are the sole producers in the industry, the industry quantity supplied at price P2 is equal to

A. Q1 + Q3. B. Q1 + Q2. C. Q2 + Q4. D. Q4 - Q2.

Refer to the given information. If the price level P is 4, Q is:

Answer the question on the basis of the following information for a hypothetical economy. All values are in nominal terms. M = $100 V = 2 C a = $160 X n = $10 G = $10 A. 50. B. 100. C. 200. D. 500.