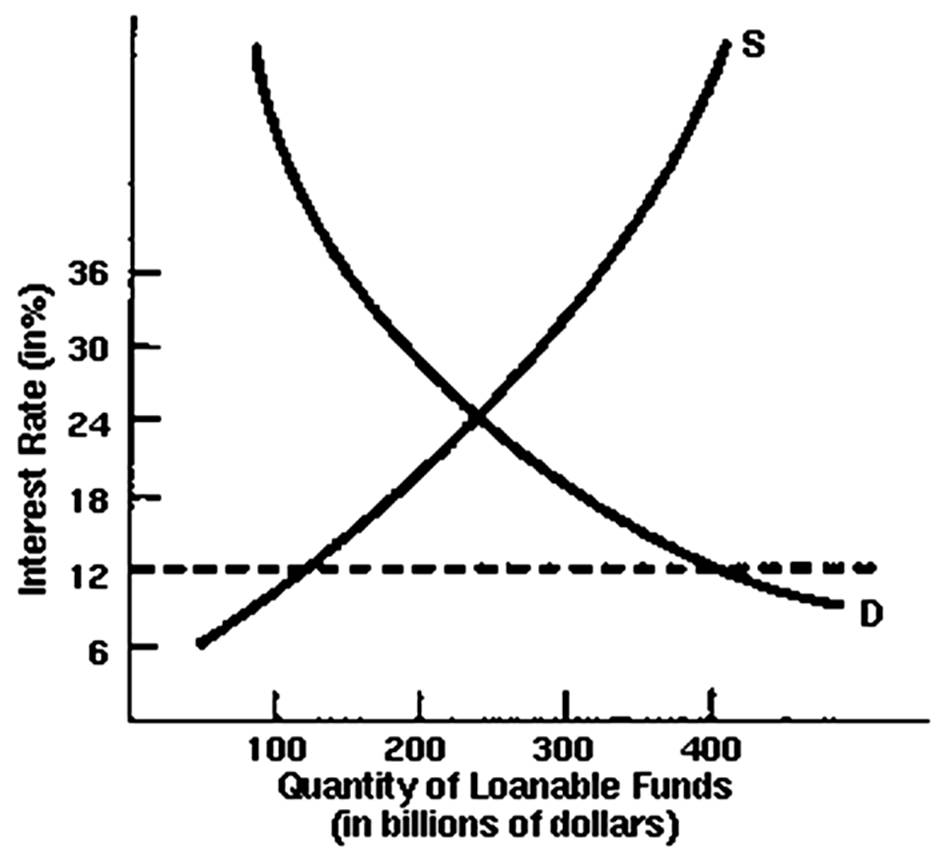

How much would the interest rate be if there was no usury law?

24%

You might also like to view...

Taxes distort economic behavior because they

A) change the composition of income and spending. B) cause deviations in economic behavior from the efficient, free-market outcome. C) change the balance between private and public expenditures. D) change the composition of consumption, investment, government spending, and net exports.

A customs duty is an example of a(n)

a. use tax b. payments tax c. excise tax d. transactions tax e. process tax

If a central bank increases the money supply in response to an adverse supply shock, then which of the following quantities moves closer to its pre-shock value as a result?

a. both the price level and output b. the price level but not output c. output but not the price level d. neither output nor the price level

The fact that output gaps will not last indefinitely, but will be closed by rising or falling inflation is the economy's:

A. income-expenditure multiplier. B. self-correcting property. C. short-run equilibrium property. D. long-run equilibrium property.