How might the behavior of professional investment managers prior to the financial crisis of 2007-2009 contributed to the depth of the plunge of corporate and mortgage security prices during the crisis?

What will be an ideal response?

With market interest rates low and stable, investment managers may have been trying to generate high interest payments by taking greater risks in a search for yield. When the risk came to fruition during the financial crisis the prices of the riskier securities fell disproportionately.

You might also like to view...

Which of the monetary policy tools can alter both the level of excess reserves and the money multiplier?

A. The reserve requirement B. The discount rate C. Open-market operations D. The federal funds rate

When one person's opportunity cost of producing a good is lower than another person's opportunity cost of producing the same good, it is called

A) an absolute advantage. B) a comparative advantage. C) specialization. D) production possibilities. E) a trade-off.

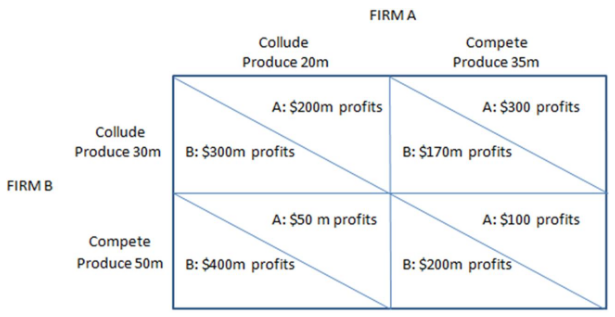

Given the payoffs in the matrix shown, Firm B:

This prisoner's dilemma game shows the payoffs associated with two firms, A and B, in an oligopoly and their choices to either collude with one another or not.

A. should always choose to collude, regardless of Firm A's actions.

B. should always choose to compete, regardless of Firm A's actions.

C. should compete if Firm A competes and collude if Firm A colludes.

D. should compete if Firm A colludes and collude if Firm A competes.

Refer Exhibit 2-10. Which of the following statements is true?

ANSWER 11.png)