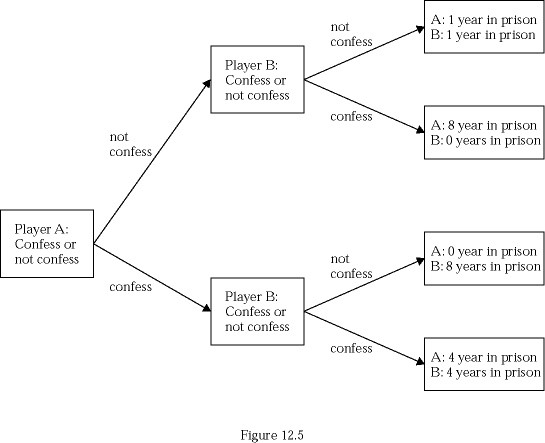

Consider Figure 12.5. If player A and Player B could cooperate, then:

Consider Figure 12.5. If player A and Player B could cooperate, then:

A. A would spend 8 years in jail and B would spend 0 years in jail.

B. A would spend 0 years in jail and B would spend 8 years in jail.

C. A would spend 4 years in jail and B would spend 4 years in jail.

D. A would spend 1 year in jail and B would spend 1 year in jail.

Answer: D

You might also like to view...

The aggregate expenditure model focuses on the ________ relationship between real spending and ________.

a. short-run; real GDP b. short-run; inflation c. long-run; real GDP d. long-run; inflation

Suppose the government has a budget surplus. Then

A) private saving is less than investment and government saving is positive. B) private saving is greater than investment and government saving is positive. C) private saving is greater than investment and government saving is negative. D) private saving is equal to investment. E) private investment is greater than the sum of government saving and private saving.

GDP is measured in terms of market value because:

a. Actually, GDP is not measured as a market value. GNP measures market values. b. Otherwise, it would be impossible to combine all the heterogeneous goods and services consumed in a nation. c. Otherwise, it would be impossible to combine all the heterogeneous goods and services produced in a nation. d. Otherwise, it would be impossible to combine domestically produced goods and services with foreign goods and services consumed by the public. e. Otherwise, it would be impossible to separate the domestically produced goods and services from foreign goods and services consumed by the public.

Table 29-1Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars) Banks ? Federal Reserve System ? Assets Liab. Assets Liab. Reserves +$10 ? U.S. Gov’t Bank Reserves U.S. Gov’t ? Sec. +$10 +$10 Securities?$10 ? ? ? ? In Table 29-1, if the required reserve ratio is 10 percent, what will happen to the money supply? Use the oversimplified money multiplier in your calculations.

A. The money supply will decrease by $100 million. B. The money supply will decrease by $10 million. C. The money supply will not change. D. The money supply will increase by $10 million. E. The money supply will increase by $100 million.