Which of these situations produces the largest profits for oligopolists?

a. The firms reach a Nash equilibrium.

b. The firms reach the monopoly outcome.

c. The firms reach the competitive outcome.

d. The firms produce a quantity of output that lies between the competitive outcome and the monopoly outcome.

b

You might also like to view...

In order to meet the dual mandate, the Fed must:

A. maintain price stability. B. maintain full employment. C. keep unemployment levels near the NAIRU. D. All of these statements are true.

Which of the following is NOT a reason why an increase in the interest rate usually makes investment projects less attractive?

A. At a higher rate, future dollars are worth less compared to current dollars. B. A typical investment project incurs the majority of its costs early in its life. C. A typical investment project receives a disproportionate fraction of its revenue early in its life. D. At a higher rate, putting money into the bank is more attractive.

Suppose policy makers pass a budget that results in a reduction in the budget deficit. Also assume that this fiscal policy action results in an increase in the saving rate. To what extent will this increase in the saving rate cause permanent changes in the rate of growth of output per worker? Explain

What will be an ideal response?

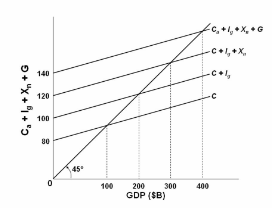

In the above graph it is assumed that investment, net exports, and government expenditures:

A. Are all increasing

B. Vary directly with GDP

C. Vary inversely with GDP

D. Are independent of GDP