History tells us that "fine tuning" of the tax code is likely to be in the public interest

a. True b. False

b

You might also like to view...

If a bottle of fine French wine costs US$250 in the U.S., 2500 rand in South Africa, there are no transaction costs, and the exchange rate is 5 rand/US$, then

A) there is an arbitrage opportunity by buying the wine in the U.S., and selling it in South Africa and the price in South Africa will drop. B) there is an arbitrage opportunity by buying the wine in South Africa., and selling it in the U.S. and the price in the U.S. will drop. C) here is an arbitrage opportunity by buying the wine in South Africa., and selling it in the U.S. and the price in the U.S. will rise. D) there is no arbitrage opportunity.

Which one of the following is least likely to influence the investment choices of decision makers?

a. the pure interest yield b. the expectation of profit c. the risk associated with the investment d. the general level of prices

For firms that sell one product in a perfectly competitive market, the market price is:

A. constant, regardless of quantity sold. B. equal to marginal revenue for a firm. C. equal to average revenue for a firm. D. All of these are true.

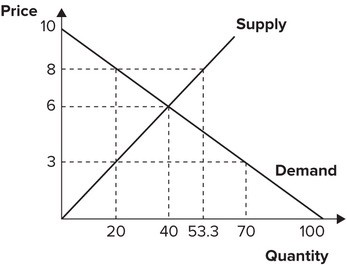

Refer to the following graph. With an effective price ceiling at $3, the effect is an implicit tax on:

With an effective price ceiling at $3, the effect is an implicit tax on:

A. consumers equal to $80. B. suppliers equal to $60. C. consumers equal to $60. D. suppliers equal to $80.