If a 10-year Treasury bond pays 3.1% and a 10-year corporate bond pays 7.4%, what is the interest rate spread on this particular corporate bond?

a. 4.3%

b. 7.4%

c. 10.5%

d. 22.9%

a

You might also like to view...

The decline in the value of the dollar from 1985 to 1988 was beneficial to

A. American tourists travelling to Europe. B. firms importing goods into America. C. American exporting businesses. D. foreigners holding U.S. government bonds.

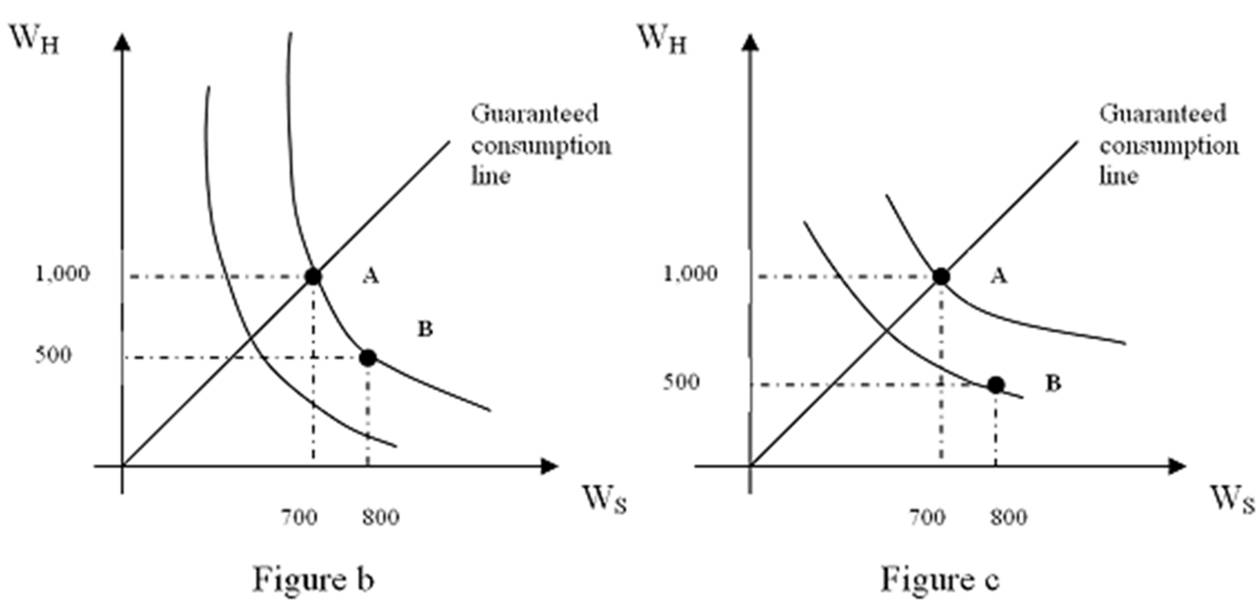

Refer to Figures b and c. In the figures above, the probability of sunny weather, state S, is higher in:

A. Figure b.

B. Figure c.

C. bundle C versus A in both figures.

D. bundle A versus C in both figures.

Some economists argue that policymakers can use monetary and fiscal policy to reduce the severity of economic fluctuations. In practice, however, there are obstacles to the use of such policies. What are the primary difficulties with using monetary and fiscal policy to stabilize the economy?

Under perfect price discrimination

A. every buyer in the market would lose his or her entire consumer surplus. B. every buyer would have to pay more than the original market price before price discrimination. C. all buyers would maximize their consumer surpluses. D. the rich buyers would benefit and the poor buyers would be hurt.