Suppose that the United States does 1/2 of its trade with Canada, 1/4 with the United Kingdom, and 1/4 with Mexico. If the dollar real exchange rate rises by 10°/o with Canada, rises by 20% for the United Kingdom, and falls by 10% for Mexico, what is the percentage change in the real effective exchange rate?

a. 11.5%

b. 10%

c. 7.5%

d. -2.5%

Ans: c. 7.5%

You might also like to view...

An increase in the average tax rate that ________ the budget deficit in an example of ________

A) raises, automatic stabilization B) raises, discretionary fiscal policy C) lowers, automatic stabilization D) lowers, discretionary fiscal policy

In the late 1960s, the Friedman-Phelps "natural rate hypothesis" predicted from the microeconomic structure of the labor market that the long-run Phillips Curve is ________, while macroeconomic events caused a very ________ acceptance of this ch

in aggregate supply theory. A) horizontal, rapid B) horizontal, gradual C) vertical, rapid D) vertical, gradual

If the nominal interest rate is 18 percent and the real interest rate is 6 percent, the inflation rate is:

A. 18 percent. B. 24 percent. C. 12 percent. D. 6 percent.

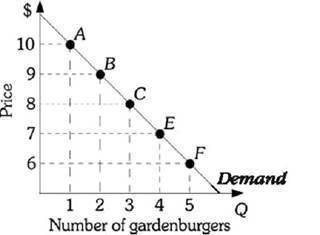

Refer to the information provided in Figure 5.3 below to answer the question(s) that follow. Figure 5.3Refer to Figure 5.3. Using the midpoint formula, if the price of a gardenburger increases from $7 to $9, the price elasticity of demand equals ________ and the increase results in a(n) ________ in total revenue.

Figure 5.3Refer to Figure 5.3. Using the midpoint formula, if the price of a gardenburger increases from $7 to $9, the price elasticity of demand equals ________ and the increase results in a(n) ________ in total revenue.

A. -0.5; decrease B. -8; decrease C. -0.375; increase D. -2.67; decrease