Let if be the interest rate being paid on a foreign bond, and let i be the interest rate being paid for a domestic bond; let P be the price of the domestic bond and let Pf be the price of the foreign bond. If exchanges rates are fixed and the bonds are equal in terms of risk:

A. if = i.

B. the expected return from the foreign bond = the expected return from the domestic bond.

C. P = Pf times units of domestic currency/unit of foreign currency.

D. all of the answers given are correct.

Answer: D

You might also like to view...

In the 1970s a typical college student's consumption might be represented by the following items: a small used car, black and white television set, macaroni and cheese and generic brand beer

As many of these students graduated from college what do you expect happened to the composition and quantity of the goods mentioned? Explain.

Sole proprietorships produce more goods and services than does any other form of business organization

a. True b. False

Which one of the following will cause the production possibilities curve to shift outward?

a. improved public education b. improved health care systems c. larger budgets for research, development, and exploration d. all of the above

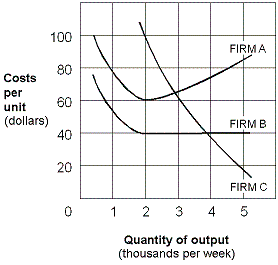

Exhibit 7-16 Long-run average cost curves

A. Firm A. B. Firm B. C. Firm C. D. Firms A and B.