Taylor would like to retire on December 31, 2026, and take a trip around the world. In order to do this, she feels she must accumulate $200,000 in her retirement account by that date. She is willing to deposit a certain amount each year into her retirement account, which earns 12% interest compounded annually. Taylor will make the first deposit on December 31, 2017, and the last deposit on December 31, 2026.

?

Required:

?

Determine the amount Taylor must deposit into her retirement account each year. Clearly label all work.

What will be an ideal response?

This problem involves the future value of an ordinary annuity where the future amount is known. The solution approach using the ordinary annuity table is as follows:??

| FVO | = C× (fOn = 10, i = 12%) |

| $200,000 | = C× 17.548735 |

| C | = $11,396.83 |

You might also like to view...

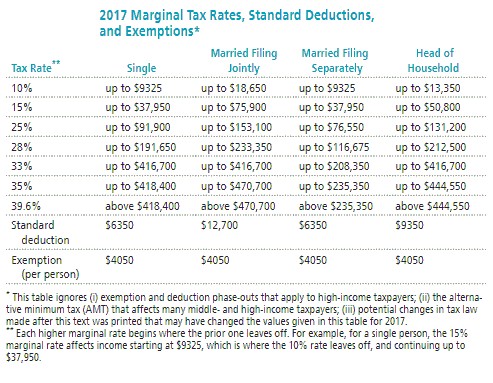

Solve the problem. Refer to the table if necessary. Stephen earned $53,158 from wages as an accountant and made $1820 in interest. Find how much he paid in FICA and income taxes. Assume he is single and takes the standard deduction. If necessary, round values to the nearest dollar.

Stephen earned $53,158 from wages as an accountant and made $1820 in interest. Find how much he paid in FICA and income taxes. Assume he is single and takes the standard deduction. If necessary, round values to the nearest dollar.

A. $10,950 B. $10,224 C. $10,924 D. $15,311

Determine the indicated term of the given recursively defined sequence.a1 = 4, a2 = 12, ak+2 = ak+1 + 8; a4

A. 12 B. 20 C. 36 D. 28

The formula to compute the future value of a single sum is:

Answer the following statement true (T) or false (F)

What type of prediction is stated in a way that permits it to be tested?

A. hypothesis B. theory C. conclusion D. conjecture