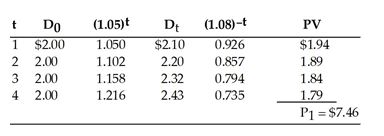

Julie's X-Ray Company paid $2.00 per share in common stock dividends last year. The company will allow its dividend to grow at 5 percent for 4 years, and after that the rate of growth will be 3 percent forever. What is the value of the stock if the required rate of return is 8 percent?

What will be an ideal response?

D5 = 2.43 (1 + 0.03) = $2.50

P2 = 2.50/0.08-0.03 × 1/(1+0.08)4 = $36.81

You might also like to view...

One lesson learned from the financial crisis of 2008 was that

A. government regulators need to respond slowly when financial practices threaten the economy. B. unregulated financial firms need to be prevented from growing so large that their failure would severely damage the economy. C. the ease of owning a home has no relationship to the efficiency of the financial system. D. unregulated financial firms need to be prevented from growing so small that their success would have no or little effect on the economy.

______ are the degree to which certain factors contribute to team effectiveness.

A. Social facilitations B. Process losses C. Synergies D. Process gains

___________ pulls demand from end users through the distribution channel

back to the original equipment manufacturers (OEMs), who feel pressure to use the branded ingredient in the goods they make. a. co-branding b. family branding c. ingredient branding d. umbrella branding e. none of the above

What is organizational image?

A. The reputation of how difficult or easy an organization’s interview process is B. The same thing as the organizational culture C. The reputation of the company in the markets that the company gets its recruits from D. A part of the realistic job preview process E. The review and acceptance process of creating a vision and mission