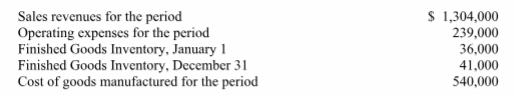

Using the information below, calculate gross profit for the period:

A) $774,000.

B) $769,000.

C) $530,000.

D) $535,000.

E) $448,000.

B) $769,000.

Explanation: Beginning Finished Goods Inventory + Cost of goods manufactured - Ending

Finished Goods Inventory = Cost of goods sold

Cost of goods sold = $36,000 + $540,000 - $41,000 = $535,000

Gross Profit = Sales - Cost of Goods Sold; Gross Profit = $1,304,000 - $535,000 = $769,000

You might also like to view...

Which of the following is likely to be considered a "supervisor" by definition of the NLRA and subsequent interpretations by the NLRB and Supreme Court?

A. Employees who occasionally assign work to other employees. B. Employees who routinely assign other employees to specific work stations but have no other supervisory responsibilities. C. Lead employees who direct other employees but where this direction is largely routine in nature. D. Employees who are accountable for the performance of other employees.

A law that creates a class that suffers a loss of freedom:

a. is constitutional b. is unconstitutional c. is allowed under the First Amendment d. is not allowed due to the First Amendment e. none of the other choices are correct

In Hicklin Engineering v. R.J. Bartell, where Bartell was accused of stealing trade secrets from his former employer, Hicklin that he now used in competition with Hicklin the appeals court held that since anyone could observe process in question at Hicklin, it was not a secret that could be protected

a. True b. False Indicate whether the statement is true or false

XML documents may be validated by comparing them to a DTD or a schema

Indicate whether the statement is true or false