Antidumping duties are the responsibilities of international environmental polluters.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Specialists work together to achieve ________ in a highly integrated organization.

A. assimilation B. a common goal C. differentiation D. decentralization E. centralization

The FIFO inventory method assumes that costs for the latest units purchased are the first to be charged to the cost of goods sold.

Answer the following statement true (T) or false (F)

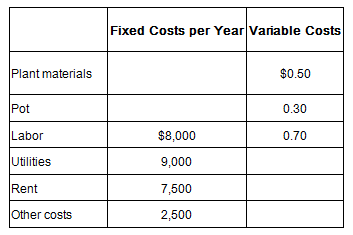

Exotic Roses, owned by Margarita Rameriz, provides a variety of rare rose bushes to local nurseries that sell Rameriz's roses to the end consumer (landscapers and retail customers). Rameriz grows the roses from cuttings that she has specifically cultivated for their unusual characteristics (color, size, heartiness, and resistance to disease). Margarita's roses are in great demand as evidenced by the wholesale price she charges nurseries, $15 per potted plant. Exotic Roses has the following cost structure (variable costs are per potted plant):

a. How many potted rose plants must Exotic Roses sell each year to break even?

b. If Rameriz wants to make profits of $10,000 before taxes per year, how many potted rose plants must be sold?

c. If Rameriz wants to make profits of $10,000 after taxes per year, how many potted rose plants must be sold assuming a 35 percent income tax rate?

The following selected data were taken from the records of the Fisher Foil Company. The company uses a job costing system to account for its manufacturing costs. Fisher's fiscal year runs from January 1 to December 31; manufacturing overhead is closed out only at the end of the fiscal year. The following information relates to August operations. (1) Jobs in process on August 1.Job No.Materials Labor OverheadW12$800 $1,200 ??X13 1,000 1,620 ??(2) Jobs completed during August: W12, X13, Y14.(3) Material requisitions and labor time tickets indicated the following:Job No.MaterialRequisitions Time TicketsW12$610 $760 X13 370 1,420 Y14 2,780 3,100 Z15 4,050 1,080 General use 390 540 (4) Jobs sold during August: W12, X13.(5) Fisher applies

overhead to production based upon labor costs.(6) Selected account balances on August 1 were: Overhead$1,400overappliedMaterials 5,175 Work in process 9,555 Finished goods -0- (7) Various overhead incurred (excluding indirect materials and indirect labor) during August, $13,500.(8) Materials (direct and indirect) purchased during August, $10,905.Required:(a) What is the balance in the Materials Inventory account on August 31?(b) Is the manufacturing overhead account over- or underapplied on August 31? By how much?(c) Compute the cost of goods manufactured for August.(d) Compute the cost of goods sold for August.(e) What is the balance of the Work-in-Process Inventory account on August 31? What will be an ideal response?