How can an insurance company offer people a deal worth taking? Why do both the buyers and the sellers of insurance gain?

What will be an ideal response?

Insurance companies work by pooling risks so that everyone pays into the pool but only the (small) fraction of people who suffer a loss are paid from the pool. Although the likelihood of a bad occurrence is small for each individual, for a large enough group the total number and total amount of losses can be estimated very closely. The insurance company can calculate the size of the pool required to cover losses. From this calculation the company can compute the amount of the premium each person must pay into the pool to cover all the anticipated losses and other costs the company incurs. People buy insurance because they are risk averse; they want to avoid unwanted outcomes. Insurance is worth buying because people are willing to give up a relatively small amount of income all the time to guarantee that they do not face the uncommon occurrence of having to give up a large amount of income since this deal increases their expected utility. An insurance company will always try to take in more in premiums paid than claims paid out to claimants so that their owners receive at minimum a normal profit.

You might also like to view...

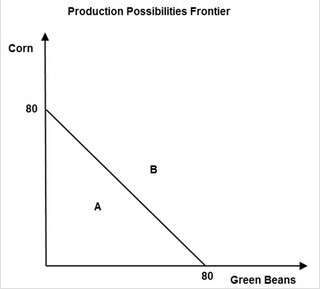

Use the following figure to answer the question below. The combination of sixty-five pounds of corn and fifteen pounds of green beans is

The combination of sixty-five pounds of corn and fifteen pounds of green beans is

A. not efficient. B. not attainable but efficient. C. attainable and inefficient. D. not attainable.

A policy of a tax cut combined with increases in government purchases would shift the aggregate demand curve to the left

a. True b. False Indicate whether the statement is true or false

Why does producer surplus decrease as price decreases?

A. Producers sell less of the good while consumers buy even more of the good. B. Consumers buy more of the good at the lower price. C. Producers sell less of the good and receive less from the lower price. D. Producers sell more of the good but receive less from the lower price.

Which of the following statements is TRUE about the market and individual firm's supply curve for labor?

A. The market supply curve is more elastic than the firm's supply curve. B. The market supply curve is perfectly inelastic and the individual firm's supply curve is perfectly elastic. C. The market supply curve is perfectly elastic and the individual firm's supply curve is perfectly inelastic. D. The market supply curve is more inelastic than the firm's supply curve.