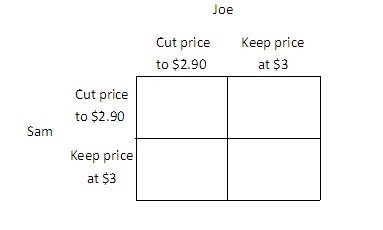

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900. You may find it easier to answer the following questions if you fill in the payoff matrix below.

width="383" />If both players choose their dominated strategy they will each earn ________, and if both players choose their dominant strategy they will each earn ________.

A. $900; $1000

B. $1000; $900

C. $500; $1350

D. $900; $1350

Answer: B

You might also like to view...

Starting from long-run equilibrium, an increase in autonomous investment results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; higher C. lower; higher D. higher; potential

If the central bank targets a rate of nominal GDP growth, then it would have to _____ money growth when nominal GDP fell below its target in order to _____ inflation and ____ real GDP

a. increase; increase; increase b. increase; decrease; decrease c. decrease; decrease; decrease d. decrease; decrease; increase

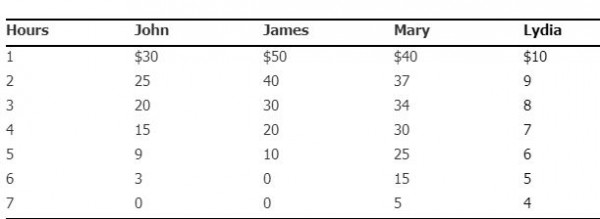

Consider the city of Widgetapolis with only four residents, John, James, Mary, and Lydia. The four residents are trying to determine how many hours to spend in cleaning up the public lake. The table below shows each resident’s willingness to pay for each hour of cleaning. Refer to Table 11-6. Suppose the cost to clean the lake is $32 per hour and that the residents have agreed to split the cost of cleaning the lake equally. It would maximize Lydia's surplus if 6 hours of cleaning is done.

a. True

b. False

Which industry or sector of the economy would least likely be affected by the business cycle?

A. Automobiles B. Capital goods C. Services D. Consumer durables