What would happen in the market for loanable funds if the government were to increase the tax on interest income?

a. The supply of loanable funds would shift right.

b. The demand for loanable funds would shift right.

c. The supply of loanable funds would shift left.

d. The demand for loanable funds would shift left.

c

You might also like to view...

If a professor gives up her job to open a shoe store, which of the following costs would an accountant tend to ignore?

A) The $1,500 per month lease for the shoe store. B) The $150 per month electricity bill. C) The $4,000 per month of income forgone by not being employed as a professor. D) The $200 business license, which, of course, is a sunk cost.

Ordinary Least Squares Regression analysis attempts to

A) maximize the distance of each point from a regression line. B) select a line that fits the data well. C) maximize the residual. D) change a multivariate problem into a single dimension.

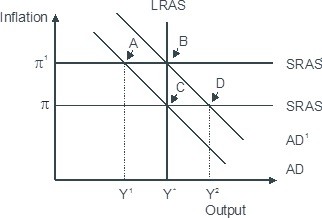

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

The largest source of tax revenue for the U.S. federal government is the corporate-profit tax.

a. true b. false