Which factor will increase the demand for loanable funds?

A. A change in the tax law to exempt savings from taxation

B. Expansion of social insurance to cover more fully the cost of retirement

C. A general business recession that produces high rates of unemployment

D. A technological advance that increases returns on investments

D. A technological advance that increases returns on investments

You might also like to view...

A grower faces a price of $0.13/pound for his/her pumpkins. The buyers of the pumpkins will buy as many pumpkins as offered by the grower at this price. The pumpkin farmer evaluates his/her costs and finds that his/her production costs (average total costs) are $0.16 per pound. He/she also evaluates the marginal cost of production and finds that the marginal cost of production at the current level of production is $0.14 per pound. The average variable cost of production at the current level is $0.12 per pound. In the short run, the producer should try to:

a. Increase amount produced to get maximum profit b. Decrease the amount produced to get maximum profit c. Leave unchanged the amount produced to get maximum profit d. Stop producing and

Suppose C = 1000 + .9Y, G = 400, I = 100, (X – IM) = 0, and there are no income taxes. If government purchases increase by 100, equilibrium GDP will

a) rise by 25% b) rise by a factor of 10 c) rise by 90 d) rise by 100 e) rise by 1,000

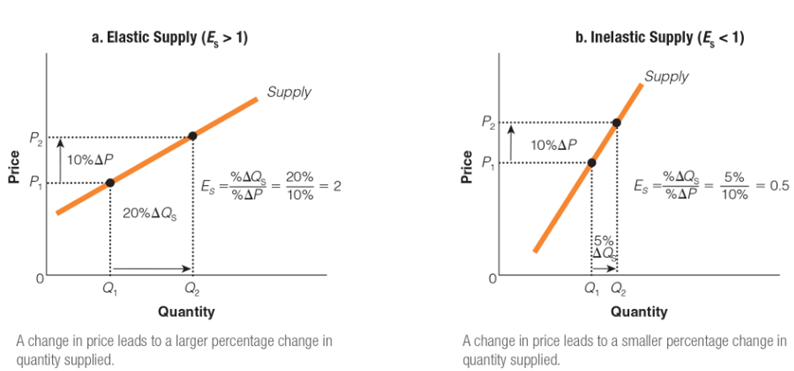

In which of the following ways is graph A different from graph B?

a. P1 to P2 is larger in graph B than in graph A.

b. Q1 to Q2 is larger in graph B than in graph A.

c. P1 to P2 is larger in graph A than in graph B.

d. Q1 to Q2 is larger in graph A than in graph B.

Answer the following questions true (T) or false (F)

1. Rising nominal GDP will increase the demand for money and short-term interest rates. 2. Buying a house during a recession may be a good idea if your job seems secure because the Federal Reserve often lowers interest rates during a recession. 3. In 2008, the Fed began paying banks interest on their reserve holdings.