The federal personal income tax is designed as a

a. progressive tax

b. regressive tax

c. proportional tax

d. poll tax

e. payroll tax

A

You might also like to view...

Suppose a price-taking firm produces 400 units at its optimal output level. At that output rate marginal cost is $200, average total cost is $240, and average variable cost is $170 . What can you determine about the market price that would force the firm to shut down in the short run?

a. It equals $200. b. It is between $170 and $240. c. It is less than $170. d. It is between $170 and $200. e. It equals $240.

Those living in the poorest quartile of countries would like to emigrate because:

A. earnings are higher for the same skill level in richer countries. B. the opportunities to gain more education are higher in richer countries. C. the cost of living is lower in richer countries. D. All of these statements are true.

When wages increase, the income effect of labor supply ________ the quantity of labor supplied because ________.

A. reduces; the price of leisure has increased B. reduces; workers acquire more of all normal goods (including leisure) when income increases C. increases; the value of working has increased D. increases; the price of leisure has increased

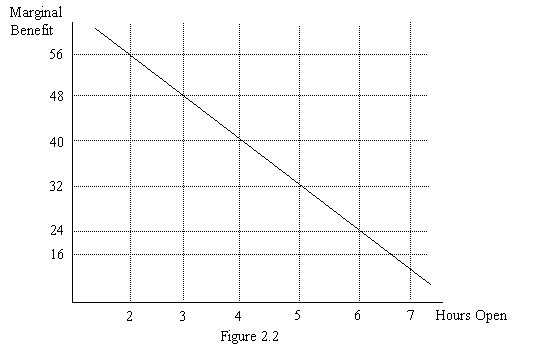

Joe runs a business and needs to decide how many hours to stay open. Figure 2.2 illustrates his marginal benefit of staying open for each additional hour. Suppose that Joe's marginal cost of staying open per hour is $32. How many hours should Joe stay open?

Joe runs a business and needs to decide how many hours to stay open. Figure 2.2 illustrates his marginal benefit of staying open for each additional hour. Suppose that Joe's marginal cost of staying open per hour is $32. How many hours should Joe stay open?

A. 4 hours B. 5 hours C. 6 hours D. 7 hours