One well-established full-service stock brokerage charges $35 commissions per trade. A new online brokerage charges $7.95 per trade. Yet, many people still elect to use the traditional, full service broker. Why?

A) They're fools.

B) They must not be aware of online brokers.

C) They might perceive the low commission to be a sign of low reliability.

D) They are failing to economize.

C

You might also like to view...

How will the invisible hand move corn prices in response to:

a. a flood that destroys a great deal of the corn crop? b. a rise in the price of wheat (a substitute for corn)? c. a change in consumer tastes away from corn dogs toward hot dogs? d. an increase in the number of people with access to the corn market?

In response to an unanticipated easing of monetary policy, output ________ at first, then ________ after about four months

A) rises; returns most of the way to its original value B) falls; returns most of the way to its original value C) remains roughly unchanged; rises significantly D) remains roughly unchanged; falls significantly

When a check is cleared against Bank A after being deposited at Bank B, _____

a. both Bank A's and Bank B's liabilities increase b. both Bank A's and Bank B's liabilities decrease c. Bank A's liabilities increase and Bank B's liabilities decrease d. Bank A's liabilities decrease and Bank B's liabilities increase e. there is an increase in the liabilities of the Federal Reserve

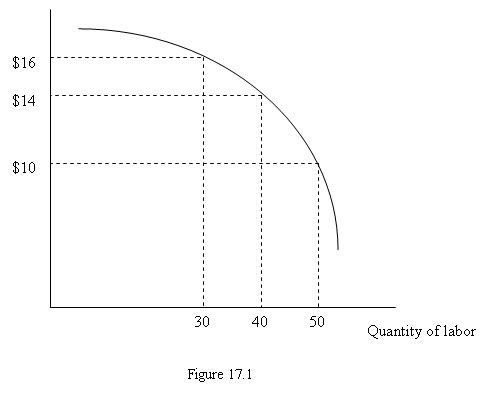

Figure 17.1 depicts a firm's marginal revenue product curve. If the firm maximizes its profit and the hourly wage is $15, how many hours of labor will the firm demand?

Figure 17.1 depicts a firm's marginal revenue product curve. If the firm maximizes its profit and the hourly wage is $15, how many hours of labor will the firm demand?

A. smaller than 30 hours B. between 30 hours and 40 hours C. between 40 hours and 50 hours D. greater than 50 hours