If the domestic interest rate increases, while the foreign interest rate and the expected spot exchange rate remain constant, the return comparison shifts in favor of investments in bonds denominated in the foreign currency.

Answer the following statement true (T) or false (F)

False

You might also like to view...

If the private sector is not willing to purchase government bonds being issued to finance a deficit, and the government's only option is to print more money, then this will likely cause

A) a lower dollar value. B) inflation. C) a run on borrowing. D) a weak stock market.

Higher interest rates increase both consumption and investment spending

Indicate whether the statement is true or false

If you think that there is a 75% chance of a stock increasing by 8% and a 25% change of it falling by 20%, what is the expected return on the stock? Report using percentages with two decimal places

What will be an ideal response?

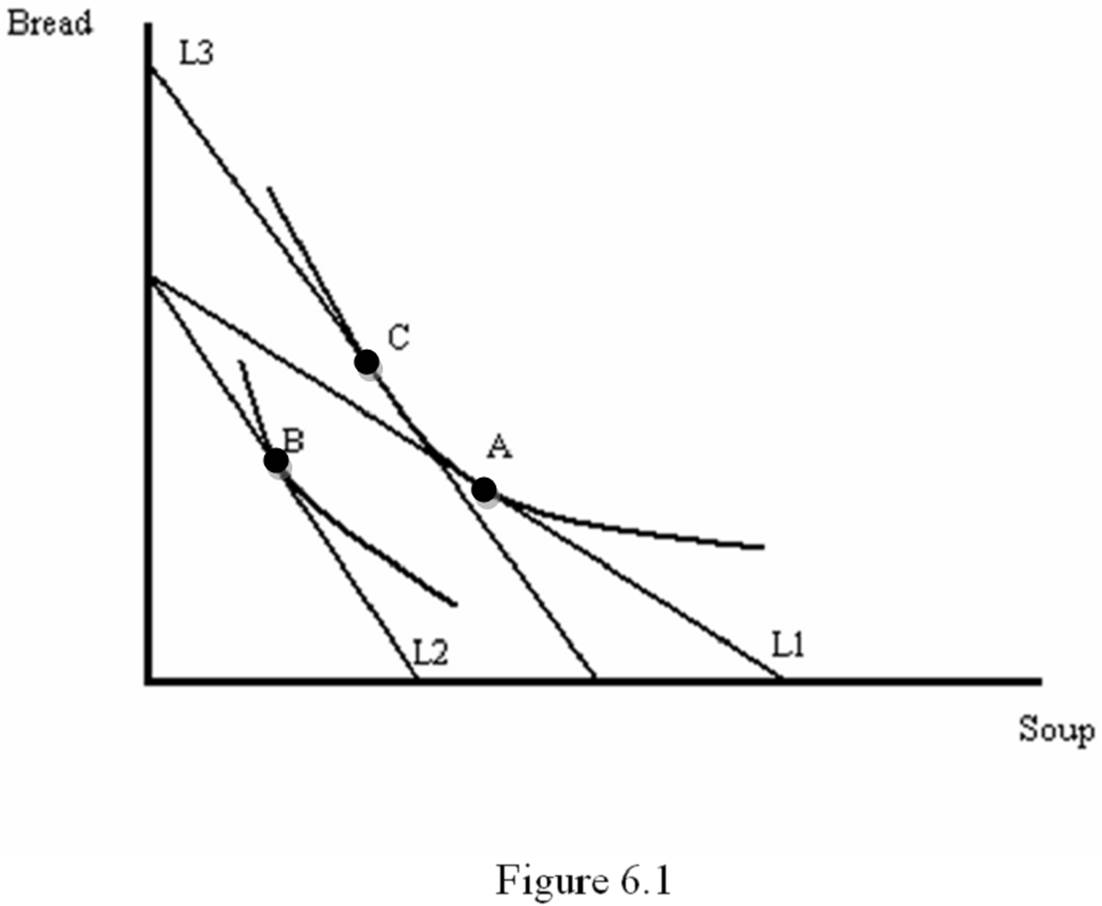

Refer to Figure 6.1. Assume that L1 represents the budget line before a price change. Point B represents the:

A. uncompensated effect of an increase in the price of bread.

B. uncompensated effect of a decrease in the price of soup.

C. uncompensated effect of an increase in the price of soup.

D. compensated effect of an increase in the price of soup.