In most markets, each consumer

a. faces the same money price and time price

b. faces different money prices and different time prices

c. faces the same money price but different time prices

d. faces different money prices but the same time price

e. has the same individual demand curve for the product

C

You might also like to view...

A firm producing a relatively large quantity before any rivals have entered the market, is an example of first-mover advantage

What will be an ideal response?

The velocity of circulation is the number of times per year a dollar is spent

a. True b. False Indicate whether the statement is true or false

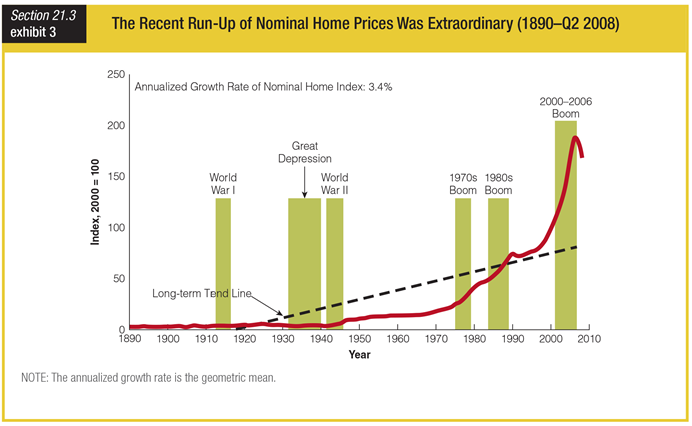

Based on the graph showing the run-up of nominal home prices, if a person had wanted to buy a house, hold it for five years, and then sell it for a profit, which of the following years would have been the best to make the purchase in?

a. 1899

b. 1941

c. 1984

d. 2001

Explain why the decoding of the human genome has interesting implications for the life insurance industry.

What will be an ideal response?