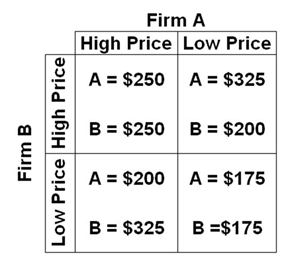

Refer to the below payoff matrix. If the two firms collude to maximize joint profits, the total profits for the two firms will be:

Answer the question based on the following payoff matrix for a duopoly in which the numbers indicate the profit in millions of dollars for each firm:

A. $350 million

B. $400 million

C. $500 million

D. $525 million

D. $525 million

You might also like to view...

What is the Hotelling Principle? Have resource prices behaved as the principle predicts?

What will be an ideal response?

A theory of regulatory behavior, which states that regulators must take into account the preferences of legislators, producers, and consumers, is the

A. general interests theory. B. public interest theory. C. share-the-gains, share-the-pains theory. D. capture theory.

In the short run, a monopolistically competitive firm can earn

A. zero, positive or negative profits. B. positive profits only. C. zero profits only. D. zero or positive profits only.

Which of the following is NOT an example of the hurdle method of price discrimination?

A. A lower price on strawberries when they are in season. B. An early-bird discount for people order dinner before 5 pm. C. A coupon for $10 off any purchase of $50 or higher. D. A mail-in rebate on a printer.