If August futures for a commodity are currently trading at $9.30/bushel, and you expect the basis in July to be $0.30/bushel over the August futures, then you expect the July cash price to be:

A. $9.05/bushel under August

B. $9.55/bushel over August

C. $9.00/bushel

D. $9.60/bushel

Ans: D. $9.60/bushel

You might also like to view...

Seventy percent of Austin's chess club wanted to purchase new chess sets and thirty percent did not. The club purchased the sets. Which method of allocation best describes the choice to purchase the sets?

A) force B) sharing equally C) command D) majority rule E) lottery

Reserve demand becomes horizontal at the IOER rate because:

A. the reserve supply is always set by the Fed so that the federal funds rate is greater than the IOER rate. B. banks will not make loans at less than the IOER rate. C. banks must earn more than the IOER rate to lend. D. the IOER rate is the upper bound of the target federal funds rate

The movement of workers from lower productivity jobs to higher productivity jobs would be an example of:

A. network effects. B. technological advance. C. simultaneous consumption. D. improved resource allocation.

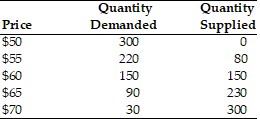

Using the above table, at a price of $70, there is

Using the above table, at a price of $70, there is

A. a shortage of 120 units. B. a surplus of 150 units. C. a surplus of 270 units. D. a shortage of 150 units.