In 2002, $1 = 1 euro, and in 2006, $1 = 0.6 euro. If the price of a Ferrari was $125,000 in 2006, then:

A) U.S. consumers partially benefited, even though the dollar depreciated.

B) U.S. consumers paid the full price because of the depreciated dollar.

C) U.S. consumers benefited because of the appreciation of the dollar.

D) one can say that the J curve effect is not valid.

Ans: A) U.S. consumers partially benefited, even though the dollar depreciated.

You might also like to view...

If increased capital usage reduces the firm's short-run demand for labor, then

a. labor is a regressive factor. b. labor and capital are complements in production. c. labor and capital are substitutes in production. d. labor is a Giffen factor.

Technological advances that increase the skill requirements for many jobs will tend to

a. make it more challenging for individuals to migrate from low-paying jobs to high-paying jobs b. make it easier for individuals to migrate low-paying jobs to high-paying jobs c. have no impact on the ease of migrating from low-paying jobs to high-paying jobs d. contribute to a more equal distribution of income e. have no impact on the distribution of income

When considering policy, measures of access to credit can often be:

A. unimportant to the economy. B. as important as the measure of money. C. included in the measures of money. D. measures of individual assets.

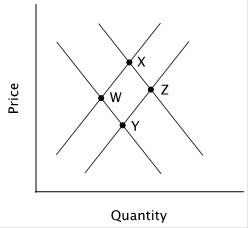

Refer to the figure below. Assume the market is originally at point W. Movement to point Y is the result of:

A. an increase in supply and an increase in demand. B. a decrease in supply and an increase in quantity demanded. C. an increase in supply and an increase in quantity demanded. D. an increase in demand and an increase in quantity supplied.