Define the components of the CAMELS criteria and explain how a CAMELS rating is calculated.

What will be an ideal response?

The CAMELS criteria are: Capital adequacy; Asset quality; Management; Earnings; Liquidity; and Sensitivity to risk. Examiners give the bank a rating from one to five in each of these categories (one being the best rating) and combine the scores to determine the overall rating.

You might also like to view...

Borrowing from abroad represents:

A) a capital outflow. B) a capital inflow. C) positive net savings. D) none of the above.

"Reciprocity pacts" started springing up in the

A) 1920s. B) 1950s. C) 1960s. D) 1980s.

Explain why the U.S. crisis became a world crisis

What will be an ideal response?

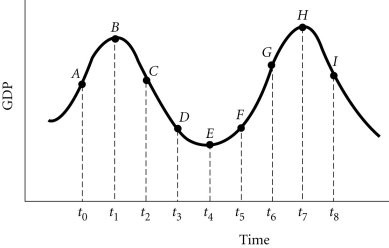

Refer to the information provided in Figure 29.1 below to answer the question(s) that follow. Figure 29.1Refer to Figure 29.1. If policy makers decide at time t2 that the economy is contracting too fast, but the policy changes start affecting the economy at t4, then the policy will be

Figure 29.1Refer to Figure 29.1. If policy makers decide at time t2 that the economy is contracting too fast, but the policy changes start affecting the economy at t4, then the policy will be

A. inappropriate. B. optimal. C. well timed. D. ineffective.