Annual incomes of James, Jack, and Stanley are $30,000, $50,000, and $80,000 and their tax rates are 10 percent, 20 percent, and 30 percent respectively. Which tax structure is this an example of?

A. Proportional tax

B. Progressive tax

C. Regressive tax

D. Digressive tax

Answer: B

You might also like to view...

An excess quantity of money demanded will lead to a rise in

A) bond prices. B) income. C) the interest rate. D) investment.

The table above gives data for the nation of Mosh. If real GDP is $6 trillion, then

A) firms increase production because inventories are less than their target levels. B) the economy has reached equilibrium and no change in production will occur. C) firms increase production because inventories exceed their target levels. D) firms decrease production because inventories exceed their target levels. E) We need more information to determine whether firms increase, decrease, or do not change their production.

A recession is a period during which

A. aggregate demand, production, and unemployment rise. B. aggregate demand, production, and unemployment fall. C. aggregate demand, production, and unemployment remain the same. D. aggregate demand and production rise while unemployment remains the same. E. aggregate demand and production fall while unemployment rises.

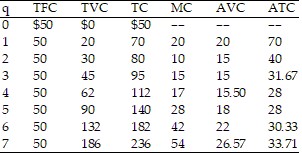

Refer to the data provided in Table 9.2 below to answer the question(s) that follow.

Table 9.2 Refer to Table 9.2. If the market price is $28 and the firm produces 5 units of output, then its profit would be

Refer to Table 9.2. If the market price is $28 and the firm produces 5 units of output, then its profit would be

A. -$50. B. -$44. C. $0. D. $18.