Paul Romer's theory of economic growth differs from traditional theories in that

A) Romer argues an investment-knowledge cycle can exist, but requires constant increases in investment rates, while traditional theories argue that investment rates can be constant.

B) Romer argues that investment in human capital always occurs before investment in physical capital, while traditional theories emphasize the priority of physical capital.

C) Romer argues an investment-knowledge cycle allows a one-time increase in investment to permanently increase a country's growth rate, while traditional theory argued such an investment would have only a short-term effect.

D) Romer argues that investment in capital goods is not important in encouraging growth while investment in human capital is, whereas traditional theorists emphasize both human and physical capital.

C

You might also like to view...

To achieve long-run equilibrium in an economy with a recessionary gap, without the use of stabilization policy, the inflation rate must:

A. not change. B. increase. C. decrease. D. either increase or decrease depending on the relative shifts of AD and AS.

If the rate of inflation is 5 percent and the real interest rate is 3 percent, the nominal interest rate should be

A) 1 percent. B) 2 percent. C) 8 percent. D) -2 percent.

The most cost-efficient input is the one that can produce the most revenue per unit of input.

Answer the following statement true (T) or false (F)

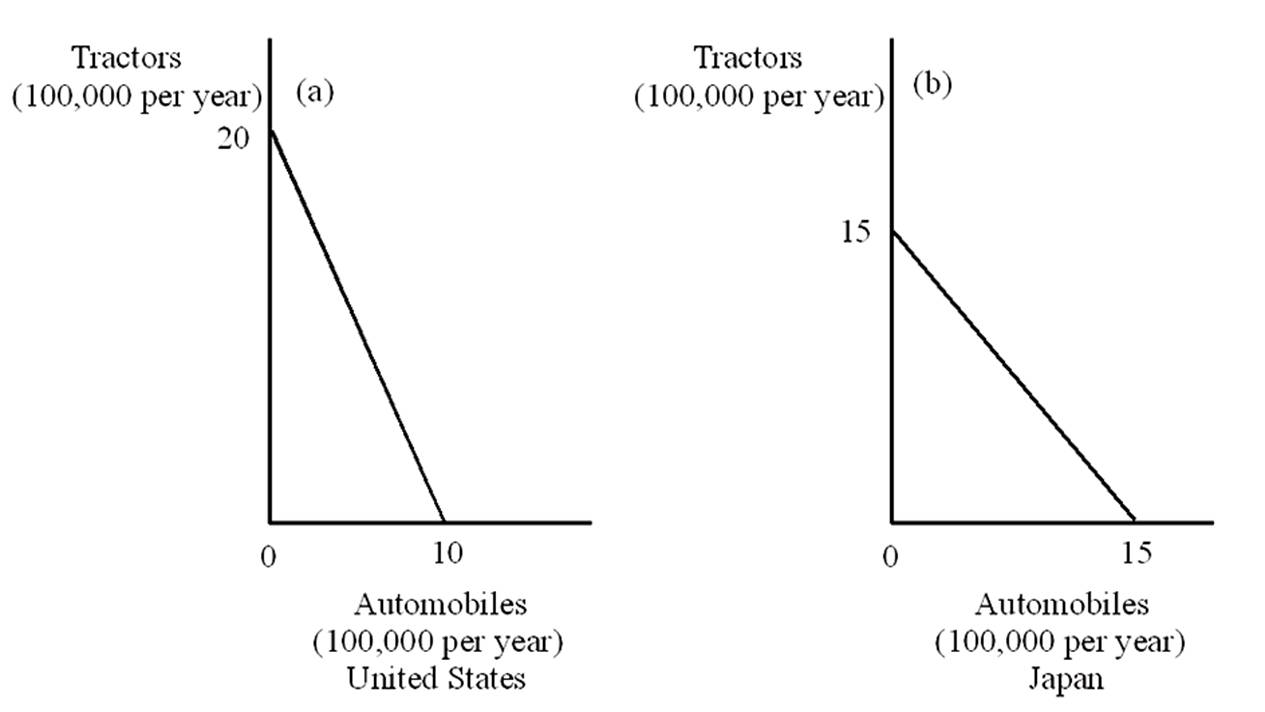

What is the opportunity cost of 1 tractor in terms of automobiles for the U.S. and Japan, respectively?

A. 0.5 automobiles and 2 automobiles

B. 0.5 automobiles and 1 automobile

C. 2 automobiles and 1 automobile

D. 2 automobile and .25 automobiles