A unit tax is an example of a(n)

a. payroll tax

b. property tax

c. estate tax

d. use tax

e. excise tax

E

You might also like to view...

Household consumption depends on both income and interest rates. In the above figure

A) household consumption is held constant. B) interest rates are held constant. C) household income is held constant. D) no variable is held constant.

Government spending and taxes

A) do not change aggregate demand. B) are an important component of aggregate supply. C) do not play a big role in determining GDP. D) are a major determinant of aggregate demand. E) cannot affect the price level.

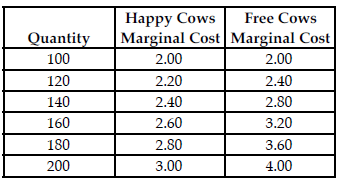

Refer to the table below. The perfectly competitive market for dairy products has a 40 percent chance of a high price of $3.00 and a 60 percent chance of a low price of $2.00. To maximize expected profit, Happy Cows should produce ________ units and Free Cows should produce ________ units.

Happy Cows and Free Cows are two separate perfectly competitive dairy farms. The table above shows the respective firms' marginal cost at various production levels.

A) 120; 120

B) 140; 120

C) 120; 140

D) 140; 140

One reason a computer manufacturer may produce its own microchips rather than buy them is that it can maintain control over production quality

a. True b. False