Suppose in a purely competitive market that American firms consider labor costs to be mostly variable while Japanese firms consider labor costs to be mostly fixed

What implication would this have for the viability of firms in each country if they compete with one another in the short run? What about the long run?

In the short run this might give the Japanese firms an advantage in that if prices fall below their average total costs but still remain above their average variable cost that they may be able to continue to enjoy an operating profit. However, if this price is below the average variable cost of the American firms it will likely lead them to shut down in the short run. However, in the long run the difference in the composition of variable and fixed costs of firms is not going to make any difference so long as the average total cost of production are the same.

You might also like to view...

According to real business cycle theorists, in modern times, economic fluctuations can largely be attributed to

A) the entry of more college graduates in the labor market. B) advancements in technology. C) large scale unemployment. D) immigration policies that increased the supply of labor.

The price elasticity of demand for an agricultural product is 0.4. This value means that, when the quantity decreases 1 percent, the price

A) falls 4 percent. B) rises 4 percent. C) falls 2.5 percent. D) rises 2.5 percent. E) rises 0.25 percent.

When the price of a good is lower than the equilibrium price,

a. a surplus will exist. b. buyers desire to purchase more than is produced. c. sellers desire to produce and sell more than buyers wish to purchase. d. quantity supplied exceeds quantity demanded.

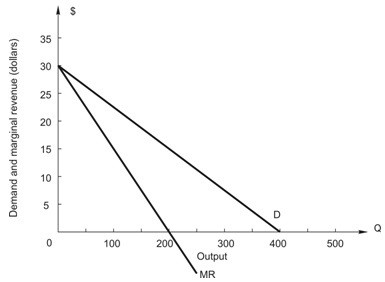

Refer to the following figure showing demand and marginal revenue for a monopoly. If production costs are constant and equal to $10 (i.e., LAC = LMC = $10), what price will the monopoly charge?

If production costs are constant and equal to $10 (i.e., LAC = LMC = $10), what price will the monopoly charge?

A. $20 B. $15 C. $10 D. $5 E. $25