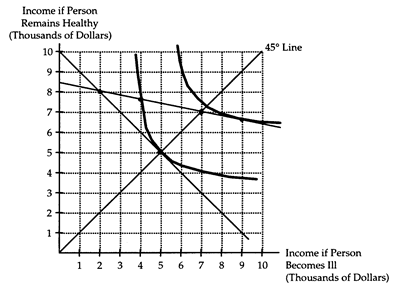

Great Benefit is a health insurance company with two types of customers: healthy persons and sickly persons. A healthy person has 1-to-5 odds of getting ill, and a sickly person has 1-to-1 odds of getting ill. However, the insurance company cannot distinguish between healthy and sickly persons. Brett is a risk-averse person who purchases health insurance from Great Benefit. Without insurance, Brett's income will be $8,000 if he remains healthy and $2,000 if he becomes ill. Brett's situation is diagrammed below.

(i) Is Brett a healthy person or a sickly person? How can you tell?

(ii) Suppose Great Benefit offers two policies-one at fair odds for healthy persons and one at fair odds for sickly persons-that can be purchased in unlimited quantities. What type of policy and how much insurance will Brett choose to purchase?

(iii) What type of information problem does the insurance company face? What limit should the insurance company place on insurance at "healthy" odds to deal with this problem?

(i) Brett is a sickly person. Along the 45° line, the slope of a person's indifference curves represents fair odds. The slope of Brett's indifference curves along the 45° line is -1, which represents the 1-to-1 odds of a sickly person becoming ill.

(ii) Brett will purchase insurance that offers "healthy" odds. He will purchase a $1,400 policy that pays $7,000 if he becomes ill. This policy places him on a higher indifference curve than a policy that offers "sickly" odds.

(iii) The insurance company faces an adverse selection problem. Brett is indifferent between a $400 "healthy" odds policy that pays $2,000 if he becomes ill and a $3,000 "sickly" odds policy that pays $3,000 if he becomes ill. To prevent Brett from purchasing insurance at "healthy" odds, the company must limit such insurance to payoffs less than $2,000.

You might also like to view...

A credible threat is:

A. possible to carry out. B. in the threatener's interest to carry out. C. legally enforceable. D. not in the threatener's interest to carry out.

Taxes levied on a firm's earnings ________ the effective cost of funds

A) lower B) raise C) have no effect D) none of the above

Crowding out occurs

a. when an increase in government spending crowds out tax revenues. b. when an increase in government spending increases investment spending. c. when an increase in government spending crowds out bonds. d. when an increase in government spending crowds out other types of spending. e. when an increase in government spending crowds out the money supply.

About what percent of total world trade is accounted for by countries that belong to the World Trade Organization?

a. 54 percent b. 72 percent c. 89 percent d. 97 percent