If a tax is imposed on a product, the buyer will always bear the entire burden of the tax

Indicate whether the statement is true or false

FALSE

You might also like to view...

If wealth ________, then saving increases, which is shown by a ________

A) decreases; rightward shift of the supply of loanable funds curve B) decreases; movement downward along the supply of loanable funds curve C) increases; rightward shift of the supply of loanable funds curve D) increases; leftward shift of the supply of loanable funds curve E) increases; movement upward along the supply of loanable funds curve

All of the following are part of the "state health insurance marketplaces" provision of the Patient Protection and Affordable Care Act (ACA) except

A) small businesses with fewer than 50 employees are exempt from being required to participate in the program. B) the marketplaces offer health insurance policies that meet certain specified requirements. C) each state is required to establish an Affordable Insurance Exchange. D) low-income individuals are eligible for tax credits to offset the costs of buying health insurance.

Ceteris paribus, which of the following is most likely to cause a decrease in the supply of skateboards?

A. An increase in the cost of materials used to produce skateboards. B. An increase in the price of skateboards. C. An improvement in skateboard-making technology. D. All of the choices are correct.

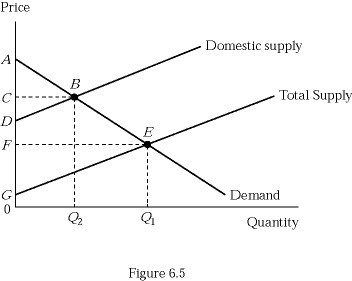

Figure 6.5 illustrates the market for sugar. With free trade, consumer surplus in the market would be shown as area:

Figure 6.5 illustrates the market for sugar. With free trade, consumer surplus in the market would be shown as area:

A. ABC. B. AEF. C. GEQ1. D. ABQ20.