Suppose that interest rates (and, therefore, the firm's weighted average cost of capital) increase. This WOULD NOT CHANGE the capital budgeting choices a firm would make if it

A) uses payback method analysis.

B) uses net present value analysis.

C) uses internal rate of return analysis.

D) uses profitability indices.

A) uses payback method analysis.

You might also like to view...

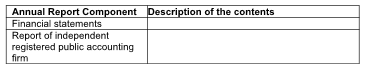

Provide a description of the contents of each of the following components of the annual report.

Companies can and often do use different costing methods for financial reporting and tax reporting. An exception to this is the:

A. LIFO conformity rule. B. Full disclosure principle. C. Consistency concept. D. Matching principle. E. FIFO inventory valuation method.

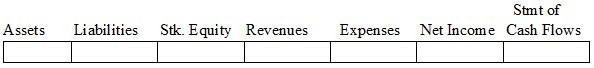

Use the following to answer questions 1?9:Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter dollar amounts. (Note that "Not Affected" means that the event does not affect that element of the financial statements or the event causes an increase in that element that is offset by a decrease in the same element.)Increase = IDecrease = DNot Affected = NADuring the process of preparing the bank reconciliation, an employee for Heath Company discovered that a check written by Barrington Company had been charged to Heath Company's account.

width="594" /> What will be an ideal response?

Which of the following statements is TRUE?

A) when a partner dies, the partnership continues to exist and is not dissolved B) when a shareholder dies, the corporation continues to exist and is not dissolved C) when a shareholder dies, the corporation is dissolved D) when a shareholder dies, their shares are must be transferred to other existing shareholders E) shareholders owe each other a fiduciary duty