Explain how changes in relative real interest rates affect the value of a nation’s currency.

What will be an ideal response?

Higher relative real interest rates in one country will cause an increase in demand for the currency of that country or an appreciation of that country’s currency as foreign investors seek higher rates of return. The reverse would be true of lower relative real interest rates.

You might also like to view...

Markets are

A) a mechanism through which prices of goods and services are determined by the forces of supply and demand. B) specific geographic locations. C) hypothetical constructs used to analyze how people form their tastes and preferences. D) places where people can inspect goods and services carefully.

A risk-free rate can be measured by

A) the rate of inflation. B) the rate on corporate bonds. C) the Federal Reserve's discount rate. D) a rate of a Treasury security.

If the economy has substantial unemployment, then the inflationary costs of expansionary policy are likely to be: a. low, and the unemployment gains minimal. b. low, and the unemployment gains large

c. high, and the unemployment gains minimal. d. high, and the unemployment gains large.

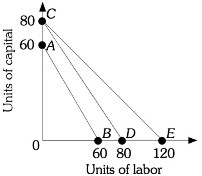

Refer to the information provided in Figure 7.8 below to answer the question(s) that follow.  Figure 7.8Refer to Figure 7.8. The firm is currently along isocost CE. If the price of labor is $24, then the price of labor is

Figure 7.8Refer to Figure 7.8. The firm is currently along isocost CE. If the price of labor is $24, then the price of labor is

A. $16. B. $24. C. $36. D. $80.