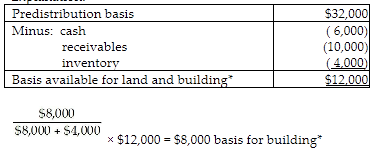

Bart has a partnership interest with a $32,000 basis. He receives a current distribution of $6,000 cash, unrealized receivables (FMV $9,000, basis $10,000), inventory (FMV $8,000, basis $4,000), investment land (FMV $7,000, basis $4,000), and building (FMV $20,000, basis $8,000). No depreciation recapture applies with respect to the building. The partners' relative interests in the Sec. 751

assets do not change as a result of the current distribution. Bart's basis in the building is

A) $3,000.

B) $4,000.

C) $6,000.

D) $8,000.

D) $8,000.

You might also like to view...

When the amount for a debit entry in a journal is transferred to a specific account in the general ledger, it must be recorded

a. as a debit to that account in the general ledger. b. as a credit to that account in the general ledger. c. in sum only, without any regard for debit or credit, since the general ledger accounts do not have spaces for debit and credit entries. d. cannot be determined without further information.

The competitive intelligence system continuously collects information from the field through ________

A) government publications B) online monitoring C) speeches D) online databases E) market surveys

Drastic modifications in the physical product may be necessary because of two problems prevalent in the developing countries: a tendency to overload equipment and to provide slight maintenance.

Answer the following statement true (T) or false (F)

After 14 grueling hours of deliberation, the jury ____ finally reached a verdict

A) has B) have