Suppose a tax equal to the value of the marginal external cost at the optimal output is imposed on a pollution generating good. All of the following will result from the tax except

A) an increase in demand for the good.

B) a decrease in the equilibrium quantity produced and consumed.

C) an increase in the equilibrium market price.

D) a decrease in market supply of the good.

A

You might also like to view...

Closing an inflationary gap involves the creation of a surplus budget where tax revenues exceed government spending

Indicate whether the statement is true or false

If the interest rate is 10 percent, the net present value of $500 to be received one year from now is

a. $413.22. b. $450. c. $454.55. d. $500.

The marginal benefit Kyra gets from eating a second sandwich is

a. the total benefit Kyra gets from eating two sandwiches minus the total benefit she gets from eating one sandwich. b. the same as the total benefit she gets from eating two sandwiches. c. less than the marginal cost of eating the second sandwich since she chose to eat the second sandwich. d. the total benefit Kyra gets from eating three sandwiches minus the total benefit she gets from eating two sandwiches.

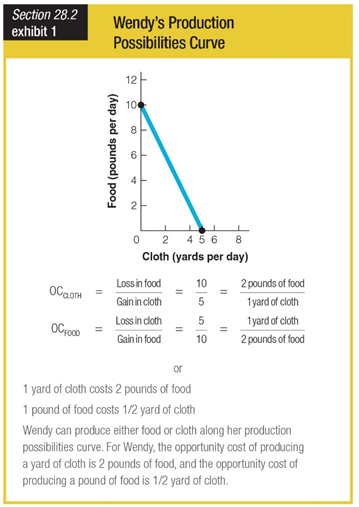

How much food production would Calvin lose in a day in order to produce 2 yards of cloth?

a. 2 pounds

b. 1-1/2 pounds

c. 1 pounds

d. 1/2 pound