Lauren runs a chili restaurant in San Francisco. Her total revenue last year equaled $111,000. The rent on her restaurant totaled $48,000. Her labor costs totaled $43,000. Her materials, food and other variable costs totaled $19,000

To Lauren's accountant, Lauren A) incurred a loss of $1,000.

B) earned a profit of $1,000.

C) incurred a loss of $111,000.

D) earned a profit of $111,000.

E) had a total cost equal to $91,000.

B

You might also like to view...

Some individuals would like to have a job, but they have given up looking for a job after an unsuccessful search. These individuals are called

a. detached workers, and they are classified by the Bureau of Labor Statistics as unemployed. b. detached workers, and they are not classified by the Bureau of Labor Statistics as unemployed. c. discouraged workers, and they are classified by the Bureau of Labor Statistics as unemployed. d. discouraged workers, and they are not classified by the Bureau of Labor Statistics as unemployed.

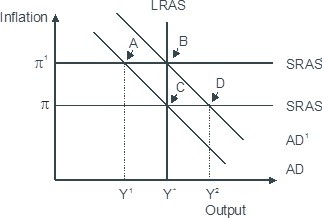

Based on the figure below. Starting from long-run equilibrium at point C, a tax cut that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. B; C C. B; A D. D; B

According to the law of demand, the quantity demanded of a good is related to

A. the relative price of that good. B. the average price of all goods. C. any factor that affects the decision of an individual consumer but not the market. D. income.

Potential output is the level of aggregate output that can be sustained in the long run without

A. unemployment. B. inflation. C. government regulation. D. taxes.