Define the following terms and explain their importance to the study of macroeconomics.

a. velocity

b. equation of exchange

c. monetarism

d. automatic stabilizer

What will be an ideal response?

a. Velocity is the number of times per year that an “average dollar” is spent on goods and services. It is calculated as the ratio of nominal GDP to the money supply. The value of the velocity number is very important in the equation of exchange.b. The equation of exchange states that the money value of goods and services demanded in the economy must equal the size of the money supply times the value of velocity. This equation underlies the monetarist theory of how money affects the macroeconomy.c. Monetarism is a method of analysis that emphasizes the equation of exchange as an explanatory theory of the macroeconomy. In contrast to Keynesian analysis, monetarism sees the stock of money as the most important determinant of the level of nominal GDP and prices. Like Keynesian analysis, it focuses on the aggregate demand side of the economy.d. An automatic stabilizer is any government program that serves to stabilize aggregate demand without policymakers having to make new decisions or take new actions. An example of automatic stabilizers would be unemployment benefits. In a recession, benefits would increase to support aggregate demand when private incomes are falling.

You might also like to view...

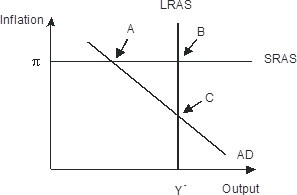

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

The unemployment rate is

A) the percentage of the labor force that is unemployed. B) the percentage of the number employed that is unemployed. C) the percentage of the working-age population that is employed. D) the percentage of the working-age population that is unemployed. E) the percentage of the labor force that is employed.

Argentina's financial crisis was due to

A) poor supervision of the banking system. B) a lending boom prior to the crisis. C) fiscal imbalances. D) lack of expertise in screening and monitoring borrowers at banking institutions.

Businesses will want to borrow more funds as the real rate of interest decreases

a. True b. False Indicate whether the statement is true or false