Make use of a T-account to show the effect of the Fed's sale of $500 million worth of government securities on the Fed's balance sheet. (assume the Fed receives a check from the sale of securities)

What will be an ideal response?

The Fed's assets decline as it has less foreign assets (international reserves) fall by $500 million and its liabilities decrease since reserves fall by $500 million.

You might also like to view...

From the table below, choose the optimum option using marginal analysis

Option Total Cost ($) 1 150 2 100 3 80 4 70 5 90 6 120 What will be an ideal response?

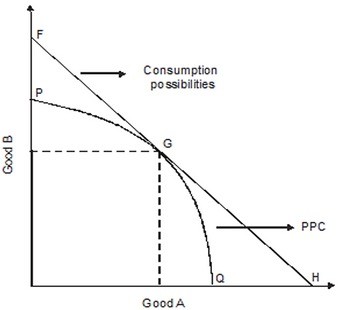

Refer to the following graph. If this country is producing between point G and Q, it will gain by ________ its production of good A and importing more ________.

If this country is producing between point G and Q, it will gain by ________ its production of good A and importing more ________.

A. increasing; good A B. decreasing; good B C. decreasing; good A D. increasing; good B

When the price of a normal good decreases, people increase their consumption of the good. The reason is

A) the law of diminishing marginal utility. B) the substitution and income effects. C) the substitution effect only. D) the income effect only.

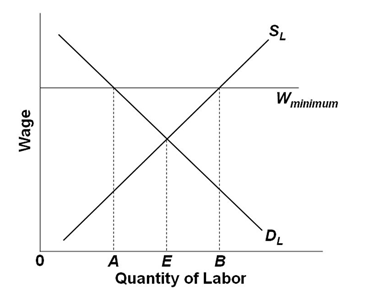

In the below graph, unemployment created by the minimum wage is:

A. B - A

B. B - 0

C. B - E

D. 0