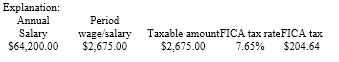

Renee is a salaried exempt employee who earns an annual salary of $64,200, which is paid semimonthly. She is married with four withholding allowances. What is her total FICA tax liability per pay period? (Do not round interim calculations, only round final answer to two decimal points.)

A) $165.85

B) $38.79

C) $204.64

D) $409.28

C) $204.64

You might also like to view...

Which of the following is a benefit of product mapping?

A) studying market matrices B) integrating target markets C) identifying market segments D) educating consumers E) integrating target matrices

Current liabilities includes all of the following except

A) ?income tax payable. B) ?mortgage due to be paid this year. C) ?notes receivable. D) ?advance payments from customers.

________ was invented by John von Neumann and Oskar Morgenstern to account for the interdependence of economic factors and it is a mathematical approach that is used to anticipate a competitor's likely future strategies

A) Regression analysis B) Game theory C) Conjoint analysis D) Linear regression

Which of the following statements concerning emotions is not true?

A. Emotions are avoidable. B. Emotions are fluid. C. Emotions are varied in their impact. D. Emotions are multilayered.