According to the monetarists,

A. the supply of money changes in response to changes in the levels of real output and prices.

B. changes in the velocity of money are more important than changes in the money supply in causing the level of economic activity to change.

C. an expansionary fiscal policy will lower interest rates and thereby tend to over stimulate the economy.

D. changes in the money supply temporarily cause changes in real output and price level but in the long run only prices change.

D. changes in the money supply temporarily cause changes in real output and price level but in the long run only prices change.

You might also like to view...

Which asset is sometimes referred to as a bank's secondary reserves?

A) vault cash B) U.S. government securities C) repurchase agreements D) federal funds

If the market price is above the perfectly competitive firm's average total cost curve, we expect that in the long run

(A) the industry contracts as firms exit the market. (B) the industry expands as firms exit the market. (C) the industry contracts as firms enter the market. (D) the industry expands as firms enter the market. (E) the government seeks to regulate the market to ensure efficient outcomes.

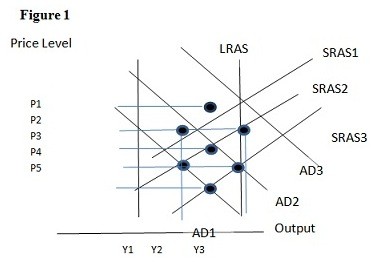

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the long run would be:

A. P2 and Y2. B. P1 and Y2. C. P4 and Y2. D. P1 and Y1.

Suppose farmers can use their land to grow either wheat or corn. The law of supply predicts that an increase in the market price of wheat will cause farmers to:

A. raise the production of wheat and corn. B. lower the production of corn and wheat. C. substitute corn for the production of wheat. D. substitute wheat for the production of corn.