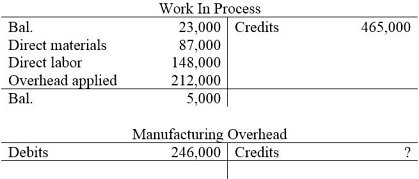

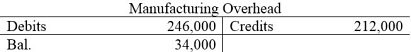

Doogan Corporation uses a job-order costing system and has provided the following partially completed summary T-accounts for the just completed period: Required:Was manufacturing overhead underapplied or overapplied? By how much?

Required:Was manufacturing overhead underapplied or overapplied? By how much?

What will be an ideal response?

| ? | Actual manufacturing overhead incurred (Debits to Manufacturing Overhead) | $246,000 |

| ? | Deduct: Manufacturing overhead applied to Work in Process | 212,000 |

| ? | Underapplied (overapplied) manufacturing overhead | $34,000 |

Alternatively,

A debit balance in Manufacturing Overhead means that manufacturing overhead is underapplied by the amount of the balance.

You might also like to view...

As it pertains to international segmentation, global segmentation refers to identifying

A. products that can be marketed in the same way across the globe. B. markets that will be favorable for exporting products internationally. C. similar patterns in cultures that can be used to segment a market. D. products that will have a global appeal. E. a group of consumers with common needs and wants that spans the entire globe.

When responding to the auditor as a result of the audit client's letter of inquiry, how might the attorney limit the response?

a. Limit the response to litigations in process. b. Limit the response to asserted claims. c. Limit the response to matters to which the attorney has given substantive attention in the form of legal consultation or representation. d. Limit the response to items which the attorney believes will result in loss to the client.

Write a user-defined function to calculate the required return on common stocks (kCS) using the H-Model as defined by (9-8) on page 264. The formula is:

1. The function should be named HModelCostEquity, and will need to accept six arguments: the initial growth rate (g1), the period of time that dividends will grow at this initial rate (n), the dividend growth rate for the remainder of time (g2), the length of the transition phase (T), the last dividend payment (D0), and the price of the share of stock today (VCS).

2. Use the function to find the solution given the following data: the last dividend payment is $0.80; the initial growth rate is 6% during the first three years. This growth rate will decline to 3% and will become constant in year 6 (T = 3 years). The price of the stock is $12.75.

Duke Company's unadjusted bank balance at March 31 is $3850. The bank reconciliation revealed outstanding checks amounting to $580 and deposits in transit of $460. What is the true cash balance?

A. $4310 B. $3850 C. $3390 D. $3730