A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

?

?

If a certain piece of equipment costs $8,100 and has a scrap value of $2,100 after 10 years, write an equation to represent the present value after t years.

What will be an ideal response?

Mathematics

You might also like to view...

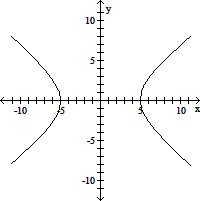

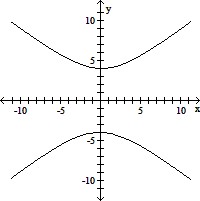

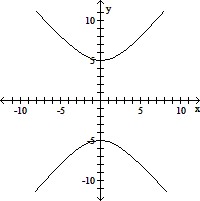

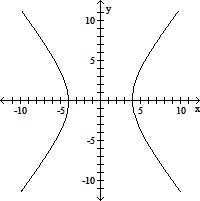

Determine the standard equation of the hyperbola with the given characteristics and sketch the graph.The center is at (0, 0), a vertex is at (0, 4), and a focus is at (0, - ).

).

A.  -

-  = 1

= 1

B.  -

-  = 1

= 1

C.  -

-  = 1

= 1

D.  -

-  = 1

= 1

Mathematics

Solve the problem.A bank loaned out $69,000, part of it at the rate of  per year and the rest at a rate of

per year and the rest at a rate of  per year. If the interest received was $7480, how much was loaned at

per year. If the interest received was $7480, how much was loaned at

A. $41,000 B. $40,000 C. $29,000 D. $28,000

Mathematics

Divide.

A. -  +

+  i

i

B.  -

-  i

i

C.  +

+  i

i

D. -  -

-  i

i

Mathematics

Find the exact function value if it exists.csc (-120°)

A. -

B. -2

C.

D.

Mathematics