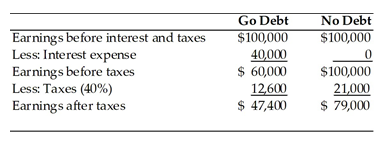

Consider two firms, Go Debt corporation and No Debt corporation. Both firms are expected to have earnings before interest and taxes of $100,000 during the coming year. In addition, Go Debt is expected to incur $40,000 in interest expenses as a result of its borrowings whereas No Debt will incur no interest expense because it does not use debt financing. Both firms are in the 21 percent tax

bracket. Calculate the earnings after tax for both firms. Compare the difference in after-tax earnings to the difference in interest expense. Can you reconcile that difference?

What will be an ideal response?

Go Debt has lower earnings after taxes compared to No Debt, and the difference is $31,600 ($79,000 - $47,400). The difference in interest expense is $40,000. The recent the difference in earnings is less than the difference in interest expense is that the interest expense that Go Debt pays saves the company $8,400 in taxes (a number which you can calculate by multiplying 21% time the $40,000 interest expense).

You might also like to view...

Discuss the structure of the media content industry

What will be an ideal response?

Experience and studies suggest that all of the following can lead to design flaws EXCEPT:

A. the pressure for fast design development B. a lack of coordination and incentives C. the use of CAD D. determining the unmet needs of the customer

A company is preparing its cash budget for the coming month. All sales are on account. Given the following: Beginning Balances Budget AmountsCash$50,000 Accounts Receivable 180,000 Sales $800,000 Cash disbursements 780,000 Depreciation 25,000 Ending accounts receivable balance 210,000 What is the expected cash balance of the company at the end of the coming month? (CIA adapted)

A. $40,000. B. $70,000. C. $45,000. D. $15,000.

Suppose two dice, one blue and one red, are rolled and the outcomes of each are recorded. We

define the following two events: A: sum of the roll is 7 B. the result of the blue die is a number greater than 4 Are the two events, A and B, independent events? A) Yes B) No